Chestnut Flats, affordable apartment complex on Chattanooga’s Southside, moves forward

Chestnut Flats, an affordable apartment complex planned for Chattanooga’s Southside neighborhood, took a step forward Wednesday.

The city of Chattanooga’s Health, Educational and Housing Facility (HEB) Board unanimously approved a request from the Elmington Group of Nashville to redo the paperwork for the project with a new lender: Federal Home Loan Mortgage Corp., more commonly known as Freddie Mac, instead of the Department of Housing and Urban Development (HUD).

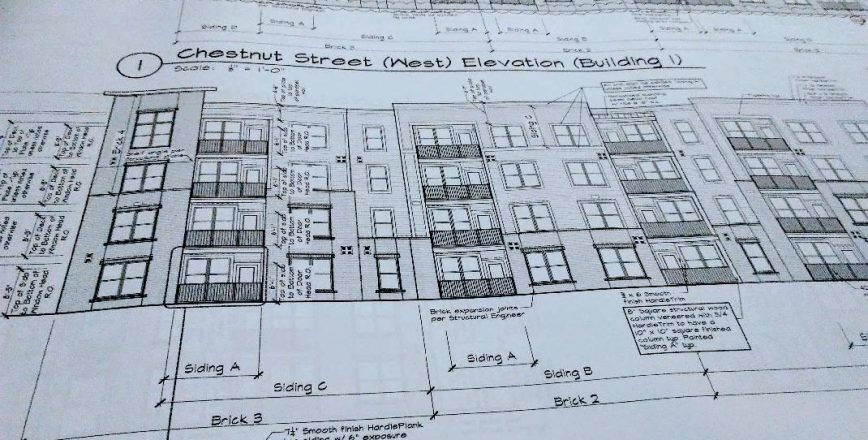

That should speed up development of the $17 million, 174-unit complex on a vacant 3-acre lot at 2108 Chestnut St. about a third of a mile south of Finley Stadium.

“We’ll close on the property by the end of this year and start construction,” John Shepard, vice president of multi-family acquistions at Elmington Capital, told the HEB Board.

HUD has been busy, he said, with hurricane-related funding requests.

“HUD is not really fast on a good day,” Shepard said. “Freddie Mac is a lot faster, execution-wise.”

Elmington Capital expects to commit to Freddie Mac next week and put down several hundred thousand dollars, Shepard said, unless HUD comes through before then.

Aside from a new lender, nothing else has changed about the proposed apartment complex, he said.

“It’s the same project, same units, we actually already have a building permit,” Shepard said. “Nothing has changed, substantively, about the building project.”

Chestnut Flats will offer a mixture of one- and two-bedroom apartments, each renting for $600-$750 a month.

The Chattanooga City Council and Hamilton County Commission each approved a payment in lieu of taxes (PILOT) agreement for Chestnut Flats under which the developer won’t pay property taxes on the increased value of the site for 10 years after a two-year construction period. The developer then benefits from a five-year phase-in period in which it will pay a portion of the full taxes until the rate reaches 100 percent in the fifth year.

The project will pay all taxes normally allotted to the Hamilton County school system for the entire period.

In return for the tax break, the developer promises to restrict tenants to households that earn no more than 60 percent of the average median income. The 60 percent average median income threshold tops out at $36,720 for a family of four.

Helen Burns Sharp, founder of watchdog group Accountability for Taxpayer Money, has called the project the city’s “first good housing PILOT application since 1992.”